The impact of the Coronavirus has been dramatic and disruptive. Information Technology (IT) impacts have been mixed.

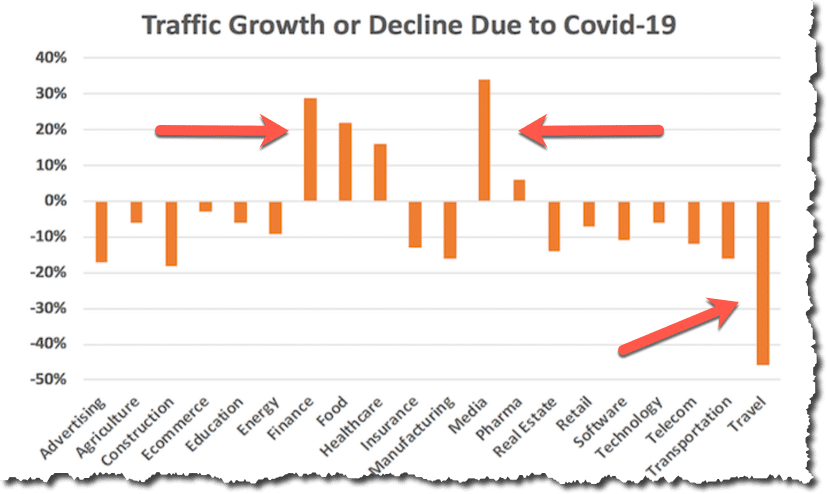

Many sectors have experienced drastic reductions while others have experienced significant growth. Streaming media for example experienced growth, while others such as travel took a beating.

This trend will continue for several months but it will be interesting to see the downstream results in terms of growth.

Web traffic is a good indicator of sector growth given the current quarantine guidelines. Areas like e-Commerce and Entertainment have seen gains based on this data.

Big Data and AI (Artificial Intelligence) also play a key role in terms of growth and strategic planning for many companies due to the impact of a pandemic.

This is where the traditional approach to IoT may shift. Companies like Disney and Carnival who have invested heavily in the creation of customized and proprietary IoT technologies may have to consider different use cases and adapt a new approach and strategy. These technologies are contingent on having people in places whereby the technology can be used to generate new and innovative experiences. This technology can be adapted to solve problems associated to social distancing and contact tracing provided the complexity and cost associated with this adaptation are not cost prohibitive. The question really comes down to time to market based on complexity and cost. It will be a race.

Other companies have taken a very different approach. Cellular technology and embedded smart-IoT enablement is also being used to generate new seamless experiences which are not reliant on location awareness using a customized infrastructure.

This is in part a bi-product of the ubiquity of networks and the inherent security it offers for WiFi, BLE and 5G. The ability to “tap into” social networking data combined with device intelligence which is non-proprietary appears to be a more viable long-term strategy in most cases where the IoT infrastructure is too costly.

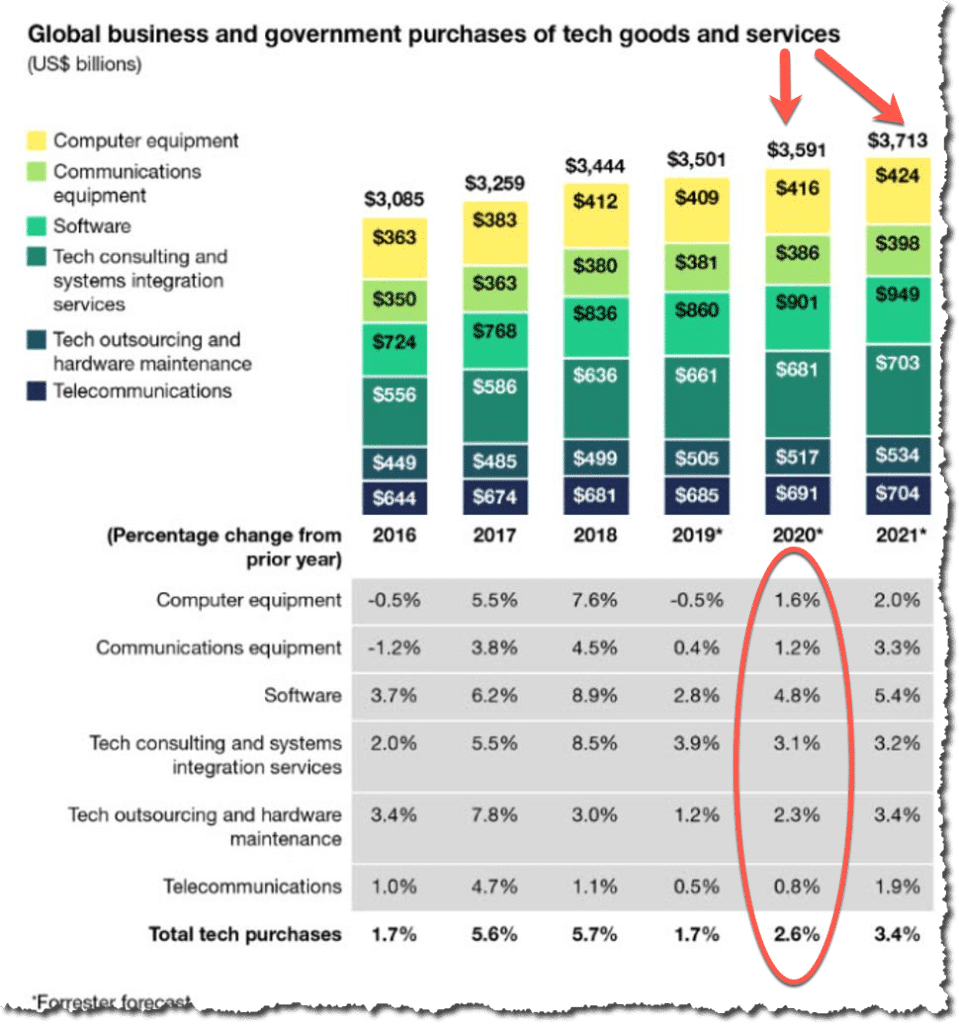

Looking at the device trend characteristics which have been impacted over the past few months it is clear that software-aware capabilities continue to trend higher than pure device-only technology markets. This data suggests that while new purchases may be down, investment in creating software that provides value continues to be profitable. The ability to take existing technology and create new use cases which are target to “health and wellness” will more than likely see the highest profits.

Companies like Forrester are making compelling predictions. Their current outlook is predicting the US and global tech market growth slowing to around 2% in 2020. This assumes the US and other major economies that experienced COVID-19 decline in the first half of 2020 will recover in the second half of the year.

Further, Forrester predicts that “if a full-fledged recession hits, there is a 50% probability that US and global tech markets will decline by 2% or more in 2020. In either a second-half 2020 recovery or recession, Forrester predicts computer and communications equipment spending will be weakest, with potential declines of 5% to 10%.” …

This data reenforces my earlier observation pertaining to IoT investment, since software continues to innovate and manufacturing evolves, it would make sense to invest in “smart-technologies” which leverage native IoT integration options in common devices like cellular and smart-things rather than custom developed IoT infrastructure which has limited reach and is complex and expensive to implement and maintain.

For those larger corproations that have already made the investment in readers and sensors, there may be unique advantages and new opportunities to offset those expenditures through morphing the application of the technology. For example, re-think what could function as a reader, or a sensor and leverage that direction using a modified version of the IoT device. Many existing devices support those types of event-driven capabilities.

Companies without the technical currency in terms of highly-skilled development resources may elect to adopt cheaper and more common platforms for their battle against this pandemic – it becomes a commodity play in terms of IoT since social data mining can often publish event and geo-location information which could be mined for contact tracing and personal awareness, while not real-time, it may be close enough for many use cases especially given the incubation period of 14 days for the virus. All these scenarios will play out over the next few years as commodity driven IoT evolves.

This pandemic has changed the way IT professionals are working. The benefits of an increased geo-diverse, remote workforce have huge downstream cost savings. The overall implications are still evolving as the economy recovers. Nothing is for certain, but if we all had a crystal ball, I would suspect that remote collaboration and reductions in physical work locations are going to be the norm moving forward. The integration of IoT and Big Data using AI will be a game changer. Companies that are not willing to innovate and adapt may not survive.